Powered by |

|

The Trust Score utilizes credit information from Equifax® to corroborate tenant-submitted information, giving landlords a secure & accurate measure of applicant’s suitability while simplifying the tenant screening process.

Reading the Trust Score

The Trust Score is a comprehensive tenant screening tool designed to measure a renter’s reliability. Compare applicants at a glance with a single score, then view a detailed breakdown to see key information like:

Equifax® credit summary including credit score range

Income verification

Court Records

Risk Assessment

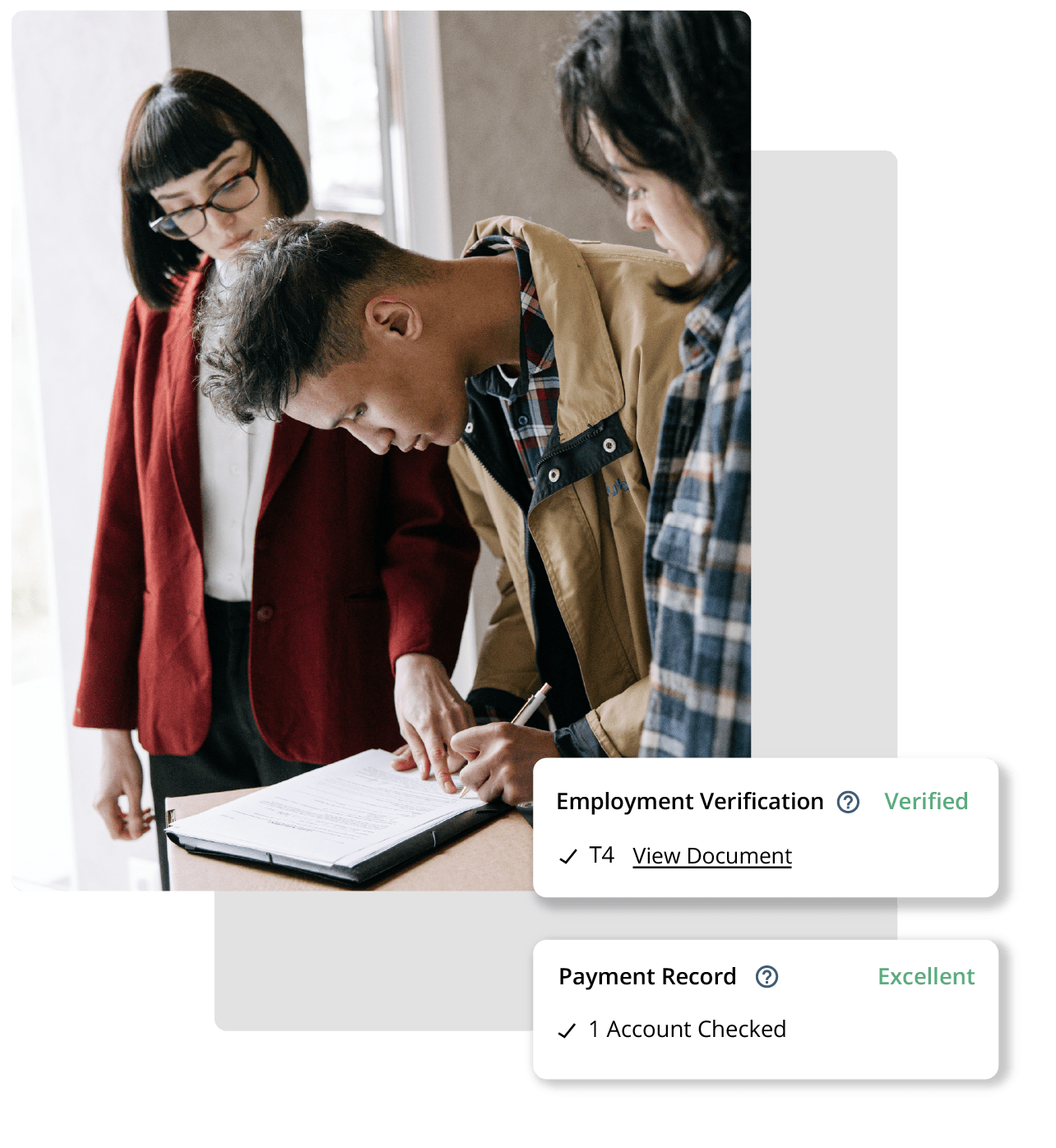

Employment Verification

And more

Protect your investment

The wrong tenants can quickly lead to complaints, costly damage, and missed rent payments. Here’s why the Trust Score is such an important tool for today’s landlords:

Interest rates

With Canada’s rising interest rates, it’s more important than ever to minimize vacancies and cut out missed rent payments.

Minimize risk, maximize profit

Prevent costly repairs and vacancies to keep your rental business profitable by avoiding troublesome tenants altogether.

More than a credit check

Find the right tenants the first time. The Trust Score looks beyond finances to give you an accurate picture of applicants’ reliability.

How to unlock the Trust Score

For liv.rent tenants

To unlock Trust Score reports for tenants on liv.rent, you will need to create a listing on liv.rent and have tenants apply.

Create a listing on liv.rent.

Ensure that both your listing and ID are verified.

Once your listing is published, you will have to wait to receive an application from a renter.

If you would like to view the Trust Score report of a renter who applied, click “Unlock Trust Score”.

Complete payment to unlock the full Trust Score report.

If you are under a Growth or Business plan or have previously purchased a Tenant Screening Report package, you can redeem your credits to unlock.

For tenants outside of liv.rent

To unlock Trust Score reports for tenants outside of liv.rent, you will need to compile their information for submission.

Sign up for a liv.rent landlord account.

Ensure that your ID is verified.

Once you have completed your sign up and are logged in, navigate to the “Trust Score” tab on the left-hand menu of your Landlord Dashboard.

Once you land on the /app/trust-score page, click “Start Screening“.

Follow the prompts to submit the renter’s information and complete payment.

Unlock the power of the Trust Score

Discover tenant screening solutions that bring peace of mind to your rental business.

Credit Checks

Unlimited Listings

Unlimited Inquiries

Shareable Listing Link

Company Landing Page

Multi-platform Advertisements

Pay-as-you-go

$16.99

per report

Pay-per-use

![]()

![]()

![]()

![]()

Pay-per-use

Growth

$48 per month

billed annually

2 per month

![]()

![]()

![]()

Standard

2 per month

Popular

Popular

Business

$399 per month

billed annually

15 per month

![]()

![]()

![]()

Custom

6 per month

Need more? Contact our sales team for Enterprise solutions.

Unlock the power of the Trust Score

Discover tenant screening solutions that bring peace of mind to your rental business.

POPULAR

Growth

What’s included:

2 multi-platform advertises per month

Unlimited Inquiries

Unlimited Listings

Shareable listing link

Standard company landing page

$48 per month, billed annually

Business

What’s included:

15 multi-platform advertises per month

Unlimited Inquiries

Unlimited Listings

Shareable listing link

Standard company landing page

$399 per month, billed annually

Pay-as-you-go

What’s included:

$16.99 per report

Need more? Contact our sales team for Enterprise solutions.

More than just a credit check

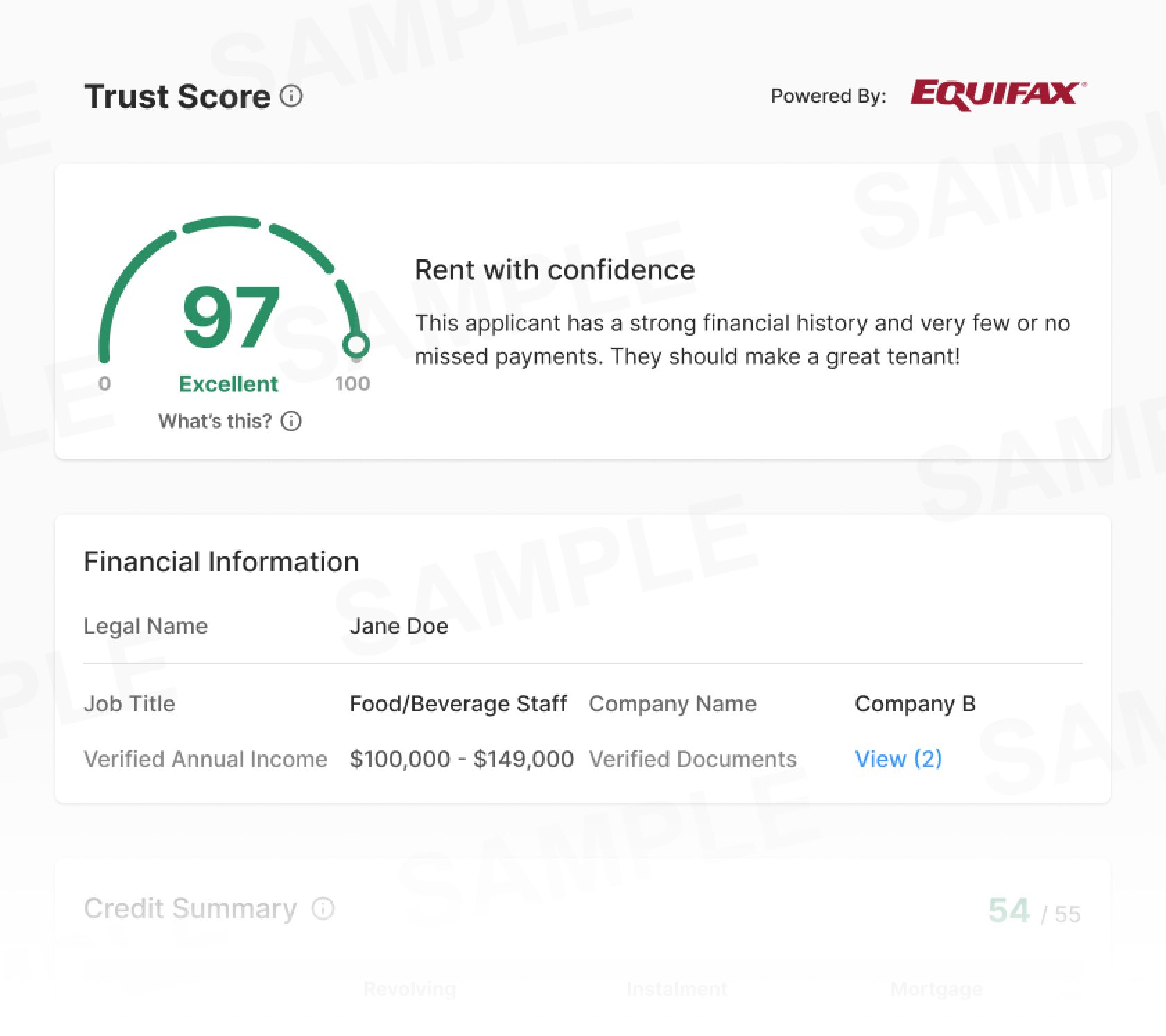

The Trust Score goes beyond credit scores to give a complete picture of prospective tenants’ reliability so you don’t miss out on rent payments. Here’s what’s included:

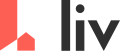

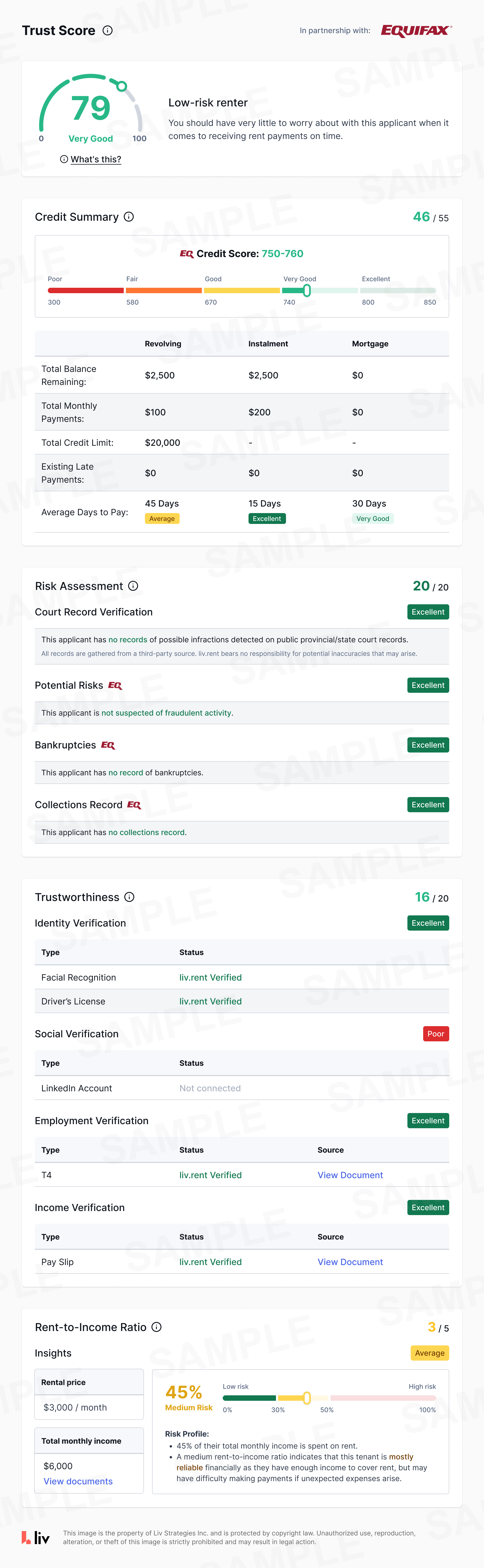

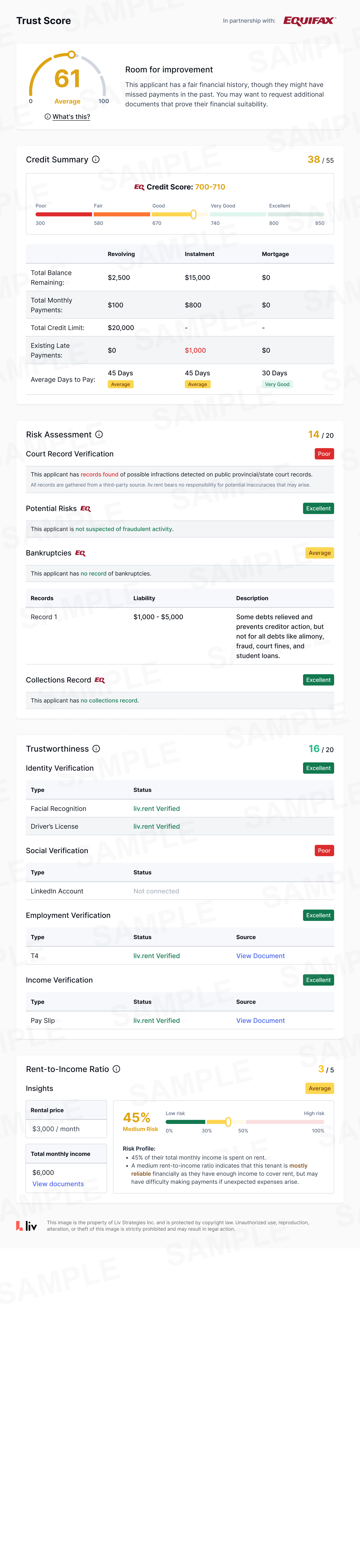

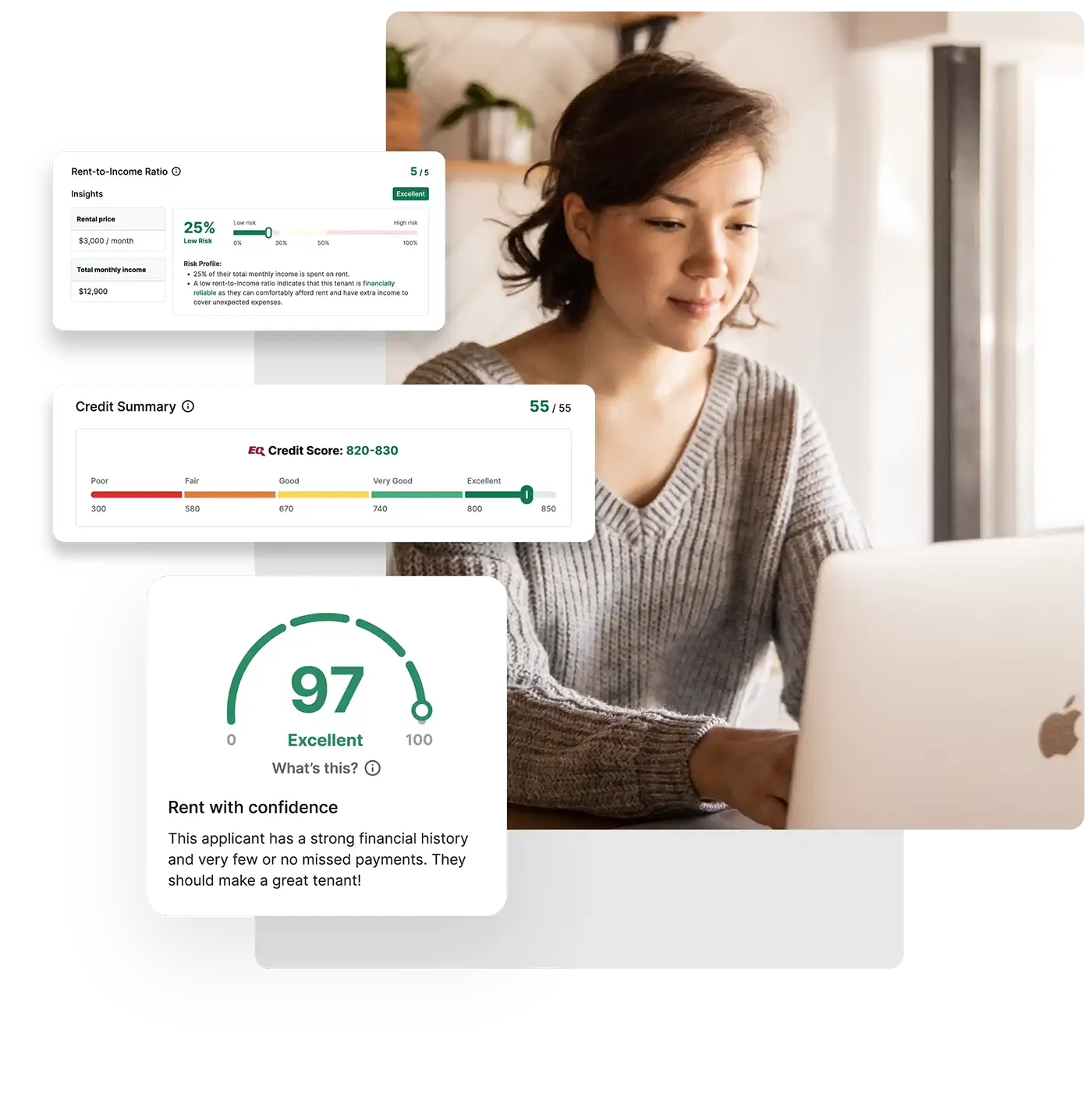

Credit Summary

An extensive analysis of the applicant’s credit history from the last 4 years on all accounts, powered by Equifax® credit checks.

Risk Assessment

An overview of potential risk factors that could affect the applicant’s ability to make rent payments on time.

Trustworthiness

A proprietary metric designed to measure applicants’ integrity and transparency by manually verifying their income, identity, employment, and more.

Rent-to-Income Ratio

A percentage calculation that evaluates applicants’ ability to pay rent, based on gross monthly income divided by the amount of their rent payments.

Learn more about the Trust Score

Build your tenant screening expertise with liv.rent’s library of Trust Score resources.

Learn more about the Trust Score

Build your tenant screening expertise with liv.rent’s library of Trust Score resources.